Agent Portal

Synergy has worked with several mid-tier insurers (located in the U.S., United Kingdom, and China) on a set of legacy issues. We have seen the effects that these legacy issues have had on each insurer. Many of the existing systems are large, monolithic applications that often are being “sunset” by the vendor with no product roadmap in place to help transition the vendor’s clients.

Our flexible portal application is a culmination of working through the common issues facing many insurers. Insurers can improve and increase their Web presence with their agents and underwriters alike.

As a key to helping you compete, we can provide you and your agents, with the ability to derive a quick quote to generate potential client interest. Our portal app allows for a seamless progression from the quick quote, to further qualifying the potential client through the application process, to creating a bound application. All the while reducing the cost and complexity of each sale and leaving your competition far behind your lead. We can work with almost any rating engine.

Leveraging Legacy

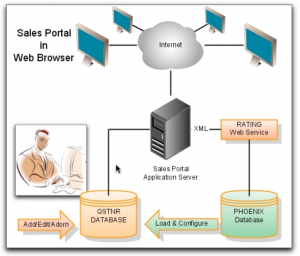

The portal app is designed to leverage an existing back-end policy system such as Phoenix.

Cost-Effective Supporting Framework

The application architecture and overall design allow us to orchestrate a “constellation” of tools to aid in the creation of the questionnaire, the “syncing” with the Phoenix database, and testing the questionnaire. This allows Underwriters and Developers to maintain the system.

- We map the legacy data to the portal view.

- Migrator ports the latest legacy data

- qCurator is used for creating new Lines of Business

- qDesigner is used to

- Maintain the questionnaire

- Maintain Underwriter referral rules

- Simulate the questionnaire

- Test the questonnaire

- The questionnaire is then versioned and published to production

Custom Workflow

We have broken down the typical policy quotation system as follows:

- Account management for agents

- Questions & answers

- Rating call

- Endorsement call

- Premium breakdown

- Form generation

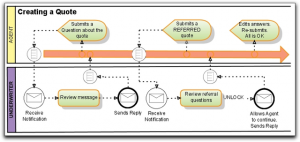

By breaking down and componentizing the primary process elements, we are able to enhance the system by adding additional workflow. This is especially critical for the Underwriter processes.

- Underwriter referral process

- Communication between Underwriter and Agent

- Agency upload of quotes from other systems

Improved User Interface

Through a strong “Separation of Concerns” architecture in our component approach, we can implement modern UI screens on top of our core system. We can also more easily support alternative delivery means, for example mobile devices.

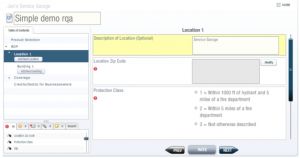

Data Driven Efficiencies

The UI is completely data-driven. What does that mean? Efficiency! We drive the contents based on the questions and rules contained in the questionnaire database. This makes it easy to rapidly stand up a new line of business and see your results immediately.

Customization

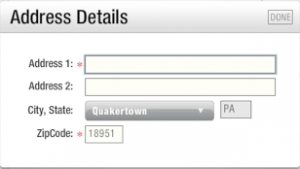

But what about customization? We have an “escape” valve mechanism that allows you to overirde the default behavior for specific questions. For example, something as simple as a set of questions that makes up an address, can take advantage of a custom UI component that presents a slightly more compact way to gather the address information from the user. (But, it isn’t required — it is an aesthetically pleasing option.)